This important notice will apply to all importers and exporters who are involved in international trade and who participate in Customs declarations in the UK.

Timetable

As from 30th September 2022, the requirement to make import declarations will move from HMRC’s CHIEF system to CDS. The ability to make import declarations from 30th September on CHIEF will therefore end, and all importers will need to transition over to the new system. For export declarations, the date is 31st March 2023.

HMRC mandatory transition from CHIEF to CDS

If Global Container Services currently complete these declarations on your behalf, then we will continue to do so, however, as an importer/exporter you will need to also prepare for this change.

The CHIEF system has been in operation for 25 years, however it is deemed not easily adaptable to new requirements, hence the reason for the Government to invest in a new system called Customs Declaration Service (CDS), which is designed for the future.

Required Information Prior to Migration to CDS

The new CDS system requires different and more data than previously.

All Customs Procedure Codes (CPC’s) are changing, and some commodity codes will require more information, this is because CDS is driven by new data requirements.

If you currently have a deferment account with HMRC and this is being used on your declarations, we will require the deferment number as usual, but we will also require your Customs Comprehensive Guarantee (CCG) to add to the declarations.

To enable us to use an importers deferment account, the importer must authorise us to use this. Please see links below.

How to Register for CDS

Step 1

Before you start, you will need the Government Gateway user ID and password that you use for:

- your business or organisation

- yourself, if you’re applying as an individual

If you do not have a user ID, you can create one when you start.

You cannot use an agent Government Gateway user ID.

To register for CDS, you will need the following

- Your Economic Operator Registration and Identification (EORI)number that starts with GB.

- Unique Taxpayer Reference (UTR) — find your UTRif you do not know it.

- The address for your business that HMRC hold on customs records – this may be different to you registered address.

- National Insurance number (Only required if you are an individual or sole trader).

- The date you started your business.

Step 2

Once you have the above information, you can register for CDS HERE – click subscribe now and login to your Government Gateway account. It can take up to 5 working days for HMRC to give you access to CDS.

You can gain access to your CDS account here – click “Start now” and login to your Government Gateway account.

Step 3

If you use Global Container Services deferment for payment of duty and VAT you can skip this step.

Importers with their own deferment account will need to setup a new direct debit. Instructions can be found here. You must keep your current direct debit in place or you will not be able to use your deferment on CHIEF entries.

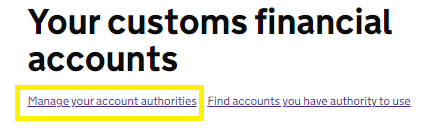

We will need you to authorise Global to use your deferment or cash account. Login to you CDS account and click ‘Manage your account authorities’, select ‘Add and authority’ and enter our EORI number GB237925341000.

When a deferment account is used, the Customs Comprehensive Guarantee number is required on all declarations. We will need your CCG number to update our records.

Useful Links & Checklist

- All customers must have a valid EORI registration.

https://www.gov.uk/eori/apply-for-eori - Customers must be registered to use CDS, if you are currently using PVA (Postponed VAT Accounting), you may have already registered for CDS.

https://www.gov.uk/guidance/get-access-to-the-customs-declaration-service - Customers with a deferment account, must create a new direct debit with HMRC for use with CDS. (Do not cancel your current deferment direct debit).

https://www.gov.uk/guidance/set-up-a-direct-debit-for-a-duty-deferment-account-on-the-customs-declaration-service - A Customs Comprehensive Guarantee number is required on all declarations when a deferment account is used. If we currently use your deferment, please advise us of your CCG number so we can update our records prior to the changeover date.

- To enable us to use your deferment account on declarations, you must authorise Global Containers to use your account. Log in to your CDS account, and click ‘Manage your account authorities’, select ‘Add an authority’ and enter the details below.

Our Details are:

Name: Global Container Services Limited

EORI: GB237925341000 - If you currently use our deferment account to settle any import Duty and/or VAT, we will continue to do this as normal, and no further action is necessary.

- If you use PVA (Postponed VAT Accounting), this will continue as normal.